Every night you sleep, a hidden thief is siphoning thousands of dollars from your storefront, without ever touching a physical card. One missed alert, one unchecked checkout, and the loss compounds until your profit margins evaporate.

According to the Federal Trade Commission, triangulation fraud incidents surged 35% last year, costing online merchants an estimated $1.8 billion in chargebacks and lost inventory. Yet most e-commerce teams have never heard of it.

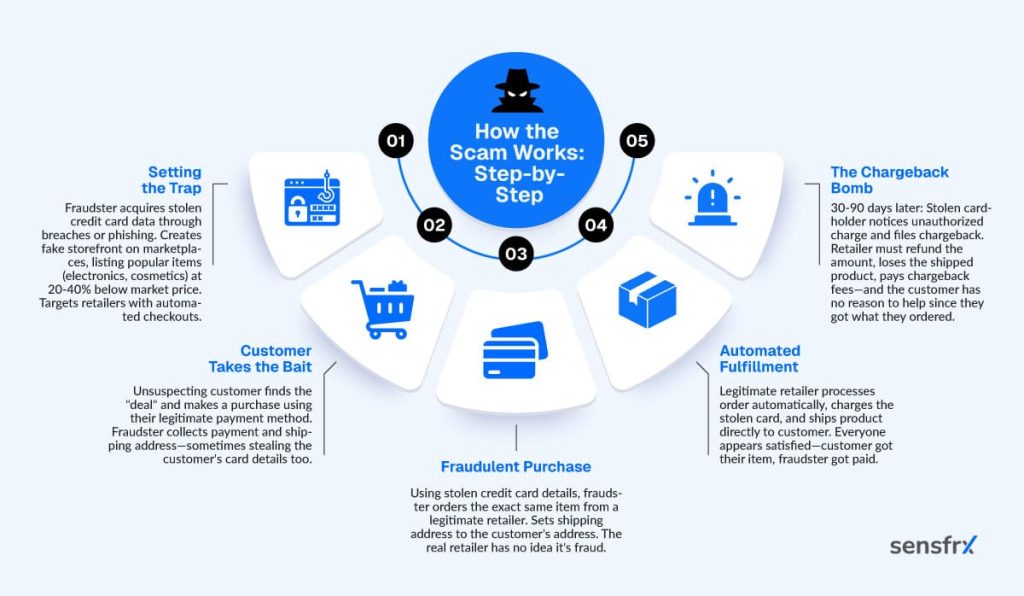

Let’s see how it works. First off, a fraudster creates a fake storefront on a marketplace, advertises a hot-selling item at a rock-bottom price, and lures a legitimate buyer. When the buyer pays, the fraudster uses stolen card details to purchase the same item from a reputable retailer, your store, has it shipped to a drop-off address they control, then forwards it to the unsuspecting buyer. They pocket the profit. You absorb the chargeback.

Having analysed breach patterns across major marketplaces, fraud analysts warn that this scheme exploits critical blind spots in vendor verification and payment monitoring systems, vulnerabilities that scale exponentially during high-traffic periods.

Why is it growing?

- FTC data: Incidents rose 35 % last year, costing online merchants about $1.8 billion in chargebacks and lost inventory.

- Blind spots: The fraud exploits weak vendor‑verification processes and gaps in real‑time payment monitoring.

- Traffic spikes: During sales events or holiday seasons, the volume of transactions overwhelms existing controls, giving the scheme more room to operate.

This article unpacks how triangulation fraud operates, why it is accelerating, and what concrete steps e-commerce teams can implement today to detect and prevent it before the damage compounds.

What is Triangulation Fraud?

Triangulation fraud is a type of CNP fraud where a criminal acts as a “secret middleman” between a genuine customer and a legitimate retailer. The scam typically involves a customer making a purchase on a third-party marketplace or fraudulent storefront, unaware that the product they receive is bought from a legitimate retailer using stolen credit card details.

The fraudster pockets the customer’s payment while the legitimate retailer faces the financial fallout. The term “triangulation” reflects the involvement of at least three essential parties in the scheme.

The Parties Involved in a Triangulation Scam

The scam can involve up to five parties, but three are critical:

- The Fraudster (Fraudulent Outlet/Seller): The criminal who creates a fake storefront or listing, armed with stolen credit card information.

- The Unsuspecting Customer (Buyer/Mule): The individual lured by attractive prices, unaware they are part of a fraudulent scheme.

- The Legitimate Supplier (Retailer/Vendor): The authentic e-commerce business that fulfils the order through automated systems.

- The Stolen Cardholder: The victim whose credit card details are used illicitly.

- The Marketplace (If Applicable): Platforms like Amazon or eBay hosting the fraudulent seller account.

How Triangulation Fraud Works: A Step-by-Step Mechanism

Triangulation fraud operates through a deceptive multistep process designed to shift losses onto the legitimate retailer:

- Setting up the Trap: The fraudster acquires stolen credit card details through data breaches, phishing, or hacks. They set up a fake online store or seller account on platforms like eBay, Amazon, or Shopify, listing popular, semi-luxury items (e.g., electronics, cosmetics) at unrealistically low prices to attract customers. They target retailers with automated checkout systems to minimize scrutiny.

- Customer Places Order: An unsuspecting customer, enticed by the deal, purchases the item using their payment method (credit, debit, or PayPal). The fraudster collects the payment and the customer’s shipping address, sometimes stealing the customer’s card details for future misuse.

- Illicit Purchase Fulfilment: Using stolen credit card information, the fraudster orders the same item from a legitimate retailer, setting the shipping address to the customer’s.

- Order Processing: The legitimate retailer processes the order, charges the stolen card, and ships the product directly to the customer, who remains unaware of the scam.

- Chargeback Disputes: The cardholder notices the unauthorized charge and files a chargeback against the retailer. The retailer must refund the amount and cannot recover the shipped product, resulting in both financial and inventory losses.

The Severe Impact and Consequences of Triangulation Fraud

Real‑World Case: The “Sneaker Flip” Scam

- Victim: A mid‑size online sneaker reseller on a popular marketplace.

- Loss: $12,800 in chargebacks over two weeks.

- Mechanics: The fraudster posted limited‑edition shoes at 30 % below market price. Buyers paid with stolen Visa cards. The reseller’s payment processor flagged the transactions only after the shoes were shipped, and the cards were already revoked.

Ripple Effects on Your Business

- Chargeback fees: Up to $100 per dispute.

- Inventory loss: Products disappear before you can verify payment.

- Brand damage: Negative reviews and lost trust from genuine customers.

Triangulation fraud is a sophisticated scam that exploits the trust inherent in e-commerce transactions, causing significant financial damage to online retailers and marketplaces. As a form of Card-Not-Present (CNP) fraud, it contributes to a staggering projected loss of over $10 billion in the U.S. alone by 2024, with global CNP fraud losses estimated at $130 billion between 2018 and 2023.

Impact on Legitimate Retailers

The financial toll extends far beyond the initial transaction. When a chargeback hits, retailers lose both the product and the payment, which is a double hit that industry data shows can accumulate to six-figure losses for small to mid-sized businesses over a single quarter.

But the damage compounds. Payment processors monitor chargeback ratios closely: exceed 1% (Visa’s threshold) or 1.5% (Mastercard’s), and merchants face escalating fines, rolling reserves, or outright account termination. For businesses operating on thin margins, even a handful of triangulation fraud cases can push them over that threshold.

Operationally, each dispute drains an average of 2–4 hours of staff time along with time and effort towards compiling evidence, responding to issuer requests, and managing customer communications. That’s bandwidth diverted from growth, fulfilment, and service.

The legitimate buyer, who received their item and sees no problem and walks away satisfied, while the defrauded retailer absorbs the blame from the card issuer. Over time, unresolved disputes erode processor relationships and can result in higher transaction fees or restricted payment options, creating a vicious cycle that strangles cash flow and stunts scalability.

Impact on Customers

Triangulation fraud harms not only merchants but also creates a cascade of victims, each facing distinct yet interconnected risks. Legitimate buyers become unwitting accomplices; they receive the product they ordered, often unaware that it was purchased with stolen credentials, and because the transaction appears successful they have no reason to report anything, unintentionally providing cover for the scheme to continue. In some cases buyers who paid the fraudster directly through unsecured channels also risk payment‑credential theft, exposing them to secondary fraud later.

Cardholders, especially elderly or financially vulnerable individuals, bear the brunt. Research from the AARP Fraud Watch Network shows that seniors account for nearly 40 % of payment‑card fraud victims, yet only 15 % successfully dispute unauthorised charges within the issuer’s timeframe. Many do not recognise unfamiliar merchant names on their statements, mistake them for legitimate purchases, or simply do not know that chargebacks are an option; by the time they realise something is wrong, the dispute window has closed and they remain financially liable.

The psychological toll compounds the financial impact. Fraud victims experience heightened anxiety, mistrust of digital commerce, and reluctance to engage in online transactions, effects that can persist for months or years. For elderly victims, shame and confusion often prevent them from seeking help, allowing fraudsters to re‑victimize them through follow‑up scams or identity‑theft schemes.

Economic Impact

The cumulative effect of lost revenue, legal fees, and supply chain disruptions can force businesses to raise prices, contributing to inflation and affecting the broader economy.

Red Flags and Characteristics of Triangulation Scams

Triangulation fraud is difficult to detect because transactions initially appear legitimate, with real customers, orders, and products. Fraudsters use “clean” credit card and billing data to avoid suspicion, but certain red flags can help businesses identify the scam.

Red Flags for Marketplaces and Seller Accounts

- Unrealistically Low Prices: Offers significantly below market rates, often too good to be true.

- Suspicious Seller Accounts: New accounts with minimal reviews but large inventories.

- Duplicated Listings: Multiple listings for the same item or brand.

- Credential Similarities: Accounts sharing similar email addresses, payment methods, or Bank Identification Numbers (BINs).

- Lack of Contact: Sellers using fake or unresponsive contact details.

Red Flags for Retailers and Transactions

- Mismatched Addresses: Significant differences between billing and shipping addresses.

- Velocity Spikes: Sudden surges in order volume or transactions from the same location in a short period.

- Targeted Items: Focus on high-value but not overly scrutinized categories like electronics, gift cards, cosmetics, laptops, or small appliances.

- Questionable Data: Legitimate-looking payment data paired with suspicious email addresses or domains (e.g., “John Smith” with an email like [email protected]).

How Businesses Can Detect and Prevent Triangulation Fraud

To combat triangulation fraud, businesses must adopt a multi-layered anti-fraud strategy combining foundational and advanced techniques.

Foundational Prevention Techniques

- Verification Measures: Use address and location verification, Risk-Based Authentication (RBA), email verification, phone number validation, and multifactor authentication.

- Historical Analysis: Regularly review transaction data for patterns like order spikes or high-risk IP addresses.

- Additional Verification: Require high-risk sellers to confirm small temporary charges (e.g., $1) to verify legitimacy.

- Employee Awareness: Train staff to recognize fraud red flags and follow reporting protocols.

- Customer Education: Encourage consumers to avoid suspiciously cheap deals and buy only from reputable sellers.

Deploying Advanced Fraud Prevention Solutions (AI/ML)

- Robust Solutions: Leverage AI and machine learning for real-time risk assessment and adaptive fraud detection.

- Behavioural and Device Analysis: Use device fingerprinting, behavioural analytics (e.g., keystroke patterns, mouse movements), and VPN checks to identify suspicious activity.

- Collaborative Insights: Tap into Global Anti-Fraud Networks for cross-industry insights.

- Continuous Adaptation: Update detection rules and models to address evolving fraud trends.

Defensive Moves That Actually Work

| Strategy | What It Does | Quick Implementation |

| Address Verification Service (AVS) | Confirms billing address matches card issuer data | Enable in your payment gateway settings |

| Device Fingerprinting | Tags each shopper’s device to spot anomalies | Add Sensfrx fraud-risk script |

| Velocity Rules | Blocks multiple high-value orders from the same IP or card in a short window | Set thresholds (e.g., > 3 orders > $500 in 24 h) |

| Manual Review for “Too Good to Be True” Deals | Human eyes catch patterns algorithms miss | Flag orders > 30 % below average price for review |

Sensfrx: Targeted Protection Against Triangulation Fraud

Triangulation fraud operates at the intersection of Identity Theft, marketplace abuse, and payment fraud. This requires a detection system that can analyse behavioural, transactional, and network-level signals simultaneously. Sensfrx addresses this by deploying machine learning models trained on over 50 million e-commerce transactions, specifically calibrated to surface the multi-layered anomalies that characterize triangulation schemes.

Sensfrx leverages the Graph-Based Pattern Recognition, unlike rules-based systems that flag individual transactions in isolation, Sensfrx maps relationships between entities among the buyers, sellers, payment instruments, shipping addresses, and device fingerprints. When the platform detects multiple orders converging on a single fulfilment address, each paid with a different card, from different “buyers”, but routed through seller accounts sharing IP infrastructure, it surfaces the hidden network structure that triangulation fraudsters rely on. In a 2024 pilot with mid-market marketplace operators, this graph-based approach reduced false positives by 43% compared to legacy fraud tools, while detecting 89% of confirmed triangulation cases within the first transaction attempt.

Sensfrx does not just check for mismatched billing and shipping addresses. Now, this is a common but noisy signal. It evaluates why the mismatch exists: Is the device fingerprint consistent with the cardholder’s historical behaviour? Is the IP geolocation congruent with the billing address, or masked through a commercial VPN service frequently associated with fraud infrastructure? Does the order velocity align with the account’s transaction history, or does it represent a sudden, unexplained spike in high-resale-value categories like electronics, luxury cosmetics, or prepaid gift cards? These layered signals, analysed in context and not in isolation, allow the platform to distinguish legitimate gift purchases or corporate buyers from fraudulent drop-shipping operations.

Preemptive and Real-Time Protection

Triangulation fraud begins with a fraudulent storefront. Sensfrx applies risk scoring to new seller registrations before the first listing goes live, flagging accounts with:

- Preemptive Seller Vetting

- Duplicated product images or descriptions.

- Pricing 20–40% below market rate (a common lure).

- Registration data linked to previously banned accounts or high-risk domains.

- Sudden, inconsistent listing volume. Marketplaces using this feature reported a 67% reduction in fraudulent seller onboarding.

- Chargeback Mitigation at Transaction Time: Sensfrx scores transactions in real time, escalating high-risk orders for review or automated decline, thus intervening before a chargeback is filed. This preemptive approach helped clients in the apparel and electronics sectors drop chargeback rates by an average of 0.4 percentage points, helping them avoid processor penalties.

- Adaptive Rules for Evolving Threats: Recognising that fraudsters change tactics, Sensfrx allows operators to define dynamic thresholds like order velocity caps or category-specific flags that adjust based on emerging threat intelligence. This adaptability is supported by Sensfrx’s threat research team, which feeds real-world attack patterns from dark web marketplaces back into the detection engine.

Conclusion: Safeguarding E-commerce Against Triangulation Fraud

As e-commerce continues to grow, triangulation fraud poses an increasing threat to businesses, exploiting trust and automation to cause significant financial and reputational damage. Proactive fraud prevention is essential to protect revenue, maintain customer trust, and avoid costly chargebacks. By adopting advanced tools like Sensfrx and staying vigilant against evolving fraud tactics, e-commerce businesses can safeguard their operations and thrive in a competitive market.

Triangulation fraud doesn’t wait, and neither should your defence. Integrate Sensfrx’s API in under 15 minutes and start blocking suspicious orders before they ship. Get real-time risk scoring, chargeback prevention alerts, and adaptive fraud detection built for today’s marketplace threats. Start your free trial to see how Sensfrx protects businesses like yours from six-figure losses.

FAQs

Unlike credit card testing or account takeover schemes that target a single victim, triangulation fraud creates a three-party scheme: the fraudster operates a fake storefront, uses stolen card credentials to purchase from a legitimate retailer, and ships to an unwitting buyer who believes they’re getting a legitimate deal. The retailer absorbs the chargeback, the cardholder faces unauthorized charges, and the buyer having received their item will never realise they participated in fraud. This multi-victim structure makes it harder to detect and prosecute.

Key indicators include multiple orders shipping to the same address but paid with different cards, sudden spikes in high-resale-value items like electronics or gift cards, mismatched buyer/seller IP addresses that resolve to the same location, new seller accounts with unusually low pricing (20–40% below market rate), and rush shipping requests from first-time buyers with minimal account history. No single flag guarantees fraud, but clustering of these signals warrants closer review.

No. Sensfrx operates in the background, scoring transactions in milliseconds without adding friction to the customer experience. High-risk orders are flagged for review or automatically declined based on your configured thresholds, while legitimate transactions proceed instantly. In pilots with mid-market retailers, Sensfrx users saw no measurable impact on cart abandonment rates and a 43% reduction in false positives compared to legacy fraud tools. Meaning fewer legitimate orders incorrectly blocked.

Yes. Sensfrx allows you to set category-specific thresholds (stricter rules for electronics vs. apparel), adjust order velocity caps, define geographic restrictions, and configure risk scores based on your tolerance and transaction volume. As fraud tactics evolve, you can update detection logic in real time, without waiting for vendor patches or manual reprogramming.

Sensfrx integrates with major e-commerce platforms (Shopify, WooCommerce, Magento, custom-builds) via API in under 15 minutes. Most merchants begin seeing risk scores and fraud alerts within hours of deployment. A free trial includes access to the full detection suite, dashboard analytics, and support documentation. For custom implementations or enterprise deployments, Sensfrx’s onboarding team provides white-glove setup and configuration.