A payday loan is a small, short-term loan you borrow to cover urgent expenses until your next paycheck. Usually, you get quick cash, but you must pay it back fast—often within 2 to 4 weeks.

They charge very high fees or interest, which can make them expensive if you can’t repay on time.

Below is a simple example of a payday loan:

- You borrow ₹5,000 as a payday loan.

- The lender states that you must repay it within 2 weeks.

- They charge a fee of ₹750 for this short-term loan.

So, when your salary comes, you have to pay back: ₹5,000 (loan) + ₹750 (fee) = ₹5,750 total

The global payday loans market was valued at $35 billion in 2023 and is expected to reach $52.3 billion by 2033.

How are payday loans being targeted by scammers as payday loan fraud?

In 2025, almost 85% of new payday loan applicants choose online platforms for their borrowing needs, which substantially increases their vulnerability to digital and app-based fraud schemes

Payday loans are already known for their high fees and short repayment periods, making them risky for borrowers. Unfortunately, scammers take advantage of this vulnerability by running payday loan fraud schemes. These scams often target individuals who are in urgent need of quick cash and may not thoroughly verify the legitimacy of the lender.

Payday loan fraud preys on financial stress. Scammers use fake promises, scare tactics, and personal data theft to exploit people when they’re most vulnerable.

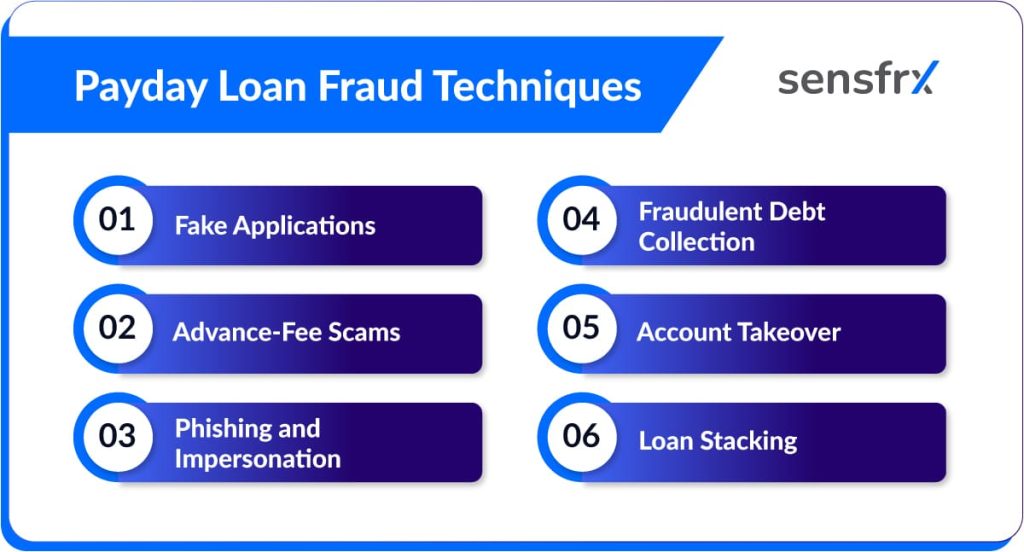

Common Payday Loan Fraud Techniques

Scammers use various fraud techniques, and some of the common ones are listed below:

Fake Applications

- Fraudsters apply for payday loans using stolen personal details sourced from data breaches or phishing attacks.

- Some create synthetic identities by blending real and fake information, bypassing weak verification checks to secure loans and disappear with the funds.

Advance-Fee Scams

- Scammers promise instant loan approval but demand upfront payments for “processing” or “insurance.” Once the fee is paid, no loan is given and the criminal vanishes.

- Real lenders never ask for payment before actually providing a loan.

Phishing and Impersonation

- Scam websites, calls, and emails mimic legitimate payday lenders to trick applicants into submitting personal data, bank details, or payments.

- Social engineering ploys include “no credit check required” offers or urgent requests that pressure victims into responding quickly.

Fraudulent Debt Collection

- Criminals pretend to be payday loan collectors, using threats and intimidation to coerce victims to pay nonexistent debts.

- They may use spoofed caller IDs and have stolen information to make the scam seem real.

Account Takeover

- Hackers use compromised login credentials to access borrower accounts, change settings, intercept loans, and drain funds before detection.

- Sometimes, money is redirected to other accounts controlled by the scammer.

Loan Stacking

- Fraudsters apply to several payday lenders at once, exploiting delays in reporting and verification. Multiple loans are issued before defaults are flagged.

Some common examples:

- An applicant receives a phone call promising a fast loan but is asked to pay a processing fee upfront. After payment, contact ceases.

- A fake website collects applications, personal details, and fees—then disappears after a short period, leaving victims exposed.

- A criminal applies for a loan using stolen identity data; the proceeds are sent to a disposable account, and fraudulent activity is only discovered when repayments default.

Key Warning Signs of a Payday Loan Scam

Before a payday loan scam creates an impact, it is critical to know what are some of the ways to detect a payday loan scam.

- Unfamiliar loans on credit reports: Discovering a payday loan entry on your credit report that you never applied for may signal identity theft or loan fraud. For instance, a consumer may notice a sudden drop in credit score due to missed payments on a loan they never took out.

- Denial of credit: When a legitimate loan or credit application is rejected, it could be because fraudulent accounts or debts have damaged your credit history. Many victims first learn of fraud when a bank denies them service.

- Debt collector calls for unknown debts: Receiving calls or letters demanding repayment for loans you do not recognize is a classic indicator of loan fraud. Scammers often use aggressive tactics and threats to collect on illicit loans.

- Lenders demanding upfront “fees”: Real lenders deduct fees from the approved loan, never ask for money before funding. Requests for convenience, insurance, or processing fees before loan disbursement are signature scam tactics. For example: A fake lender demands a $200 “insurance fee” paid via wire transfer before disbursing a payday loan, but the loan is never issued.

Application Inconsistencies

- Mismatched addresses: Loan applications may show a pattern of frequently changing or inconsistent addresses, or addresses that do not match official records.

- Unverifiable employers: Applicants list employers that cannot be confirmed, provide vague job details, or submit fraudulent employment documents.

- Tampered documents: Submitted documents may have visible signs of alteration—images/photoshopped IDs, erased or overwritten areas, or inconsistent font and formatting.

- Repeated fast-track requests: Multiple applications submitted in quick succession (loan stacking), especially from the same device or with similar personal details, often signify organized fraud.

Impact Analysis for Organizations

Fraud impacts businesses across multiple dimensions—financial, compliance, reputational, and operational—each carrying severe long-term consequences. Left unchecked, it drains resources, erodes trust, attracts regulatory scrutiny, and stalls growth.

Financial: direct losses, charge-offs, collections failures: High fraud volumes drain reserves: charge-offs accumulate, and debt collection spends rise as victims default or disappear.

Compliance: KYC/AML non-compliance, regulatory sanctions, audit findings: Failure to flag fraud can result in large fines, loss of operating licenses, or negative audit outcomes (especially if weak controls are uncovered post-fraud incident).

Reputational: trust erosion, negative reviews, public breach disclosures: Repeated fraud events damage consumer and partner trust, driving negative social media reviews and press coverage.

Operational: product launch delays/rejections, fraud management costs: Overwhelmed by fraud, lenders may halt market entry or expansion, and risk/tech teams are forced to divert resources from product innovation to crisis management.

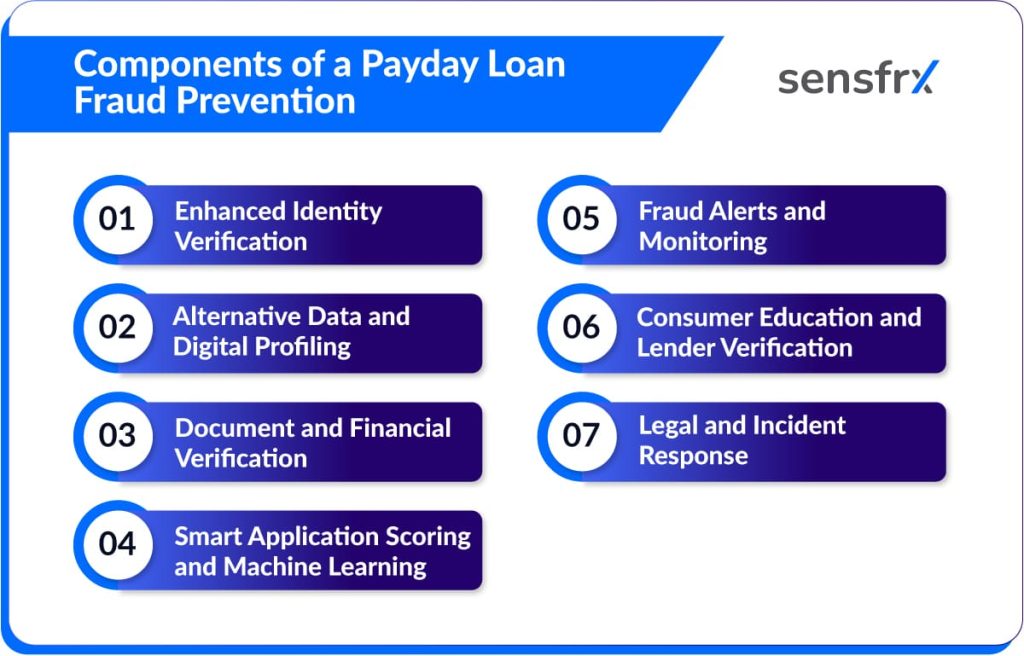

Key Components of a Payday Loan Fraud Prevention Solution

1. Enhanced Identity Verification

- Multi-layered ID checks: Use real-time automated ID and facial recognition, asking for both government ID and a live selfie, plus cross-checking with public and private databases for consistency.

- Liveliness tests: Ensure the applicant is present during verification, defeating attempts with photos or deepfakes.

2. Alternative Data and Digital Profiling

- Leverage non-traditional sources: Analyze applicants’ digital footprints, including social media presence, phone number registration, and email history, to spot patterns inconsistent with true identity.

- Device fingerprinting: Track device consistency across applications to flag multi-accounting, device rotation, and possible bot activity.

3. Document and Financial Verification

- Bank account verification: Conduct micro-deposits or direct confirmation with banking partners to ensure a real, accessible bank account before disbursing funds.

- Employer and financial history validation: Contact employers and verify bank statement authenticity directly, rather than accepting uploaded or emailed documents alone.

4. Smart Application Scoring and Machine Learning

- Dynamic risk scoring: Employ machine learning models that analyze hundreds of data points (address consistency, geolocation, transaction habits, loan stacking patterns) to highlight high-risk applications instantly.

- Continuous model updates: Regularly train models on new fraud incidents and emerging scam tactics to stay ahead of evolving threats.

5. Fraud Alerts and Monitoring

- Real-time transaction monitoring: Flag suspicious activity, such as multiple rapid applications from the same IP/address or new payee accounts being added right after loan funding.

- Automated alerts to credit bureaus: Notify bureaus and enable individuals to place fraud alerts or freezes if suspicious activity is detected on their identity.

6. Consumer Education and Lender Verification

- Customer awareness: Clearly communicate to borrowers how legitimate lenders operate—no upfront fees, official contact channels, and only registered/licensed lenders.

- Lender checks: Instruct users to confirm registration on official financial regulatory sites (e.g., RBI, SEBI), and verify the legitimacy of the lender’s website and office address before sharing personal data.

7. Legal and Incident Response

- Quick reporting: Encourage victims to report suspected fraud immediately to national cybercrime or banking ombudsman authorities.

- Internal routines: Document fraud patterns, run root cause analysis, and continuously revise onboarding and monitoring policies based on real case outcomes.

Risk Mitigation & Prevention Strategies

To stay ahead of evolving fraud tactics, organizations must adopt layered defenses that blend advanced technology, data intelligence, and continuous monitoring—creating a proactive shield rather than a reactive response. Below are some of the effective strategies that organizations can adopt:

Advanced Fraud Tools & Data Enrichment

Full digital ID profiling (alternative scoring, OSINT, live enrichment)

Using digital footprint scoring, analyzing social media, work history, and behavioral markers, live data services enrich baseline identity with real-time activity/contextual signals.

Device fingerprinting, behavioral biometrics, dynamic risk scoring

Advanced tools analyze mouse movements, typing rhythm, device specifications, and compare against established low-risk profiles, producing a dynamic risk score per application.

Email and phone analysis for credibility

Analysis of phone/email creation date, patterns of use, linked fraud complaints, or suspicious activities—e.g., disposable or recently-created emails.

Network analysis for collusion detection

Mapping connections between applications/devices/IPs to detect organized fraud rings or repeated abusers.

Robust KYC & Onboarding

Multi-source database validation, active-document verification, biometric checks

Cross-verifying applicants through multiple databases (regional/international), requiring live facial recognition matched to government ID, using liveness detection to defeat deepfakes.

Ongoing post-onboarding surveillance and transaction monitoring

Continuous monitoring so that risky post-approval behaviors—like rapid fund withdrawal to new destinations—can be immediately flagged and frozen.

AI and machine learning for pattern and anomaly detection

Deploying ML models that learn evolving fraud patterns, adapting to changes in scammer tactics without constant manual reconfiguration.

Organizational & Ecosystem Measures

Staff training, playbooks for incident response

Regularly updated training to recognize social engineering and technical frauds; incident playbooks outlining step-by-step responses for confirmed cases.

Reporting protocols and regulatory engagement

Establishing clear escalation and mandatory reporting channels aligned with local/global regulations.

Partnerships for industry-wide intelligence sharing

Active membership in fraud consortiums, instant reporting of fraud signatures for shared defense.

Below is a table representing the risks and a respective mitigation strategy:

| Risk | Mitigation Strategy |

| Evolving and sophisticated fraud tactics | Adopt layered defenses combining advanced technology, data intelligence, and continuous monitoring |

| Incomplete or outdated identity verification | Use full digital ID profiling with alternative scoring, OSINT, and live data enrichment |

| Device spoofing or abnormal user behavior | Implement device fingerprinting, behavioral biometrics, and dynamic risk scoring |

| Use of disposable or recently created email/phone IDs | Analyze email and phone credibility using creation dates, usage patterns, and linked fraud complaints |

| Organized fraud rings and collusion | Perform network analysis to map connections and detect coordinated fraud |

| Weak or fraudulent customer onboarding | Apply robust KYC with multi-source database validation, biometric verification, and liveness detection |

| Risky behavior after onboarding | Continuous post-onboarding transaction monitoring and rapid flagging of suspicious activity |

| Rapidly changing fraud patterns | Deploy AI and machine learning models for adaptive pattern and anomaly detection |

| Lack of employee awareness and incident preparedness | Conduct regular staff training and maintain incident response playbooks |

| Inefficient or unclear fraud reporting | Establish clear reporting protocols and regulatory engagement |

| Limited threat intelligence sharing | Join partnerships and consortiums for industry-wide intelligence sharing and immediate fraud signature sharing |

Best Practices for Security Managers and Risk Analysts

Security managers and risk analysts play a crucial role in shaping resilient defenses, balancing fraud prevention, customer experience, and business growth through informed, data-driven strategies.

Some of the best practices that they can follow are:

- Layered security: combining static and dynamic checks

Static checks (ID, blacklists) plus dynamic behavioral analytics (device, network, transaction) for holistic defense.

- Setting realistic friction thresholds without sacrificing trust

Modeling customer friction to minimize user dropoff while blocking high-risk profiles. - Building adaptive policies for emerging threats

Regularly updating rule sets as new fraud methods are discovered, leveraging threat intelligence feeds. - Measuring and communicating ROI of prevention investments

Tracking metrics—fraud losses avoided, augmentations in approval rates, decreased false positives—and translating them into ROI for leadership buy-in. - Continuous improvement via root cause analysis/case studies

Analyzing failed detection cases for process/policy gaps and evolving prevention strategies accordingly.

Conclusion

Payday loan identity theft is a growing threat that preys on both individuals and organizations, exploiting financial stress and gaps in verification processes. By understanding common scams, warning signs, and implementing robust prevention strategies, you can protect yourself and your business from significant financial and reputational losses.

At Sensfrx, we provide advanced fraud detection and identity verification solutions designed to stay ahead of evolving threats, combining AI-driven analytics, device fingerprinting, and continuous monitoring to safeguard your operations. Take control of fraud today—start your free trial with Sensfrx and ensure secure, reliable, and efficient payday loan processing.

FAQ’s

It’s a type of payday loan fraud where scammers steal your identity to get loans in your name.

Unfamiliar payday loan inquiries, collection calls, sudden credit score drops, or suspicious bank activity.

Contact the lender, file a police and FTC report, and add a credit freeze or fraud alert.

Use strong passwords, enable multi-factor authentication, monitor your credit report, and avoid sharing sensitive info.

People with financial struggles, data breach exposure, or those oversharing personal info online.